We are excited to introduce the – Dividend Investor Power-Up – a new feature on Wealthica. 🥳 This powerful tool acts as a dividend tracker and analyzes income from your stock investments, giving you a comprehensive view of your dividends and future dividend forecast. This will enable you to make more informed decisions about your portfolio and maximize your returns.

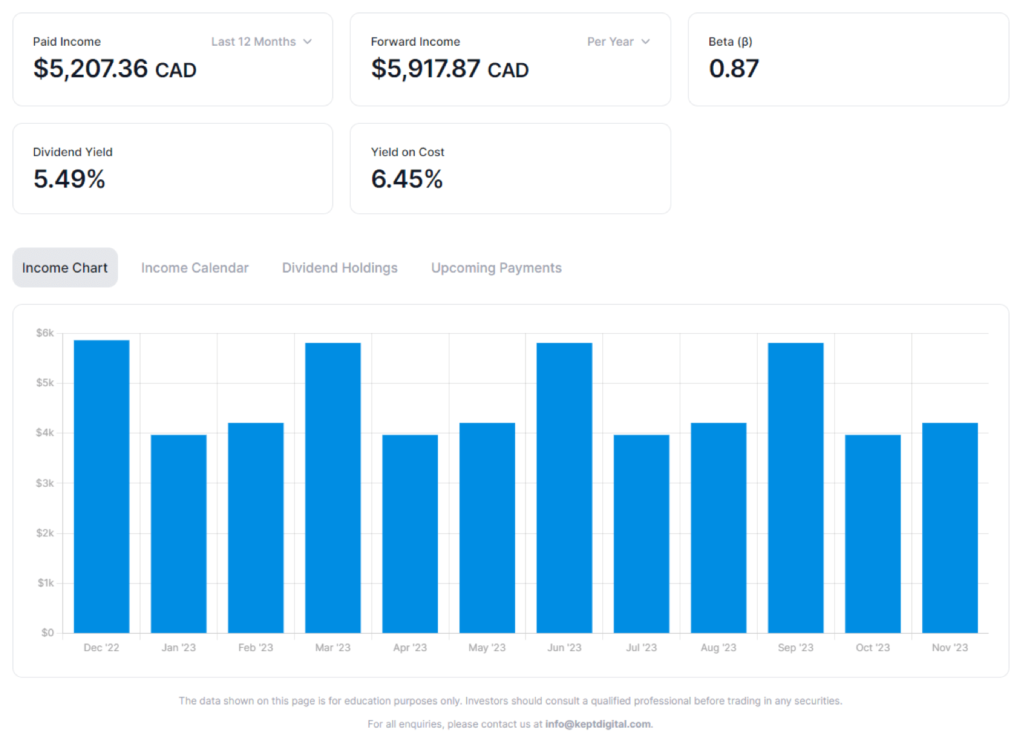

The Dividend Investor power-up offers a variety of features that are useful for investors who are focused on dividends and passive investing. For example, it provides a portfolio view of your dividend yield and yield on cost values, which can help you understand the performance of your investments. Additionally, it includes an income chart that allows you to visualize your estimated income by month, as well as an income calendar that shows you your estimated income by each holding and month.

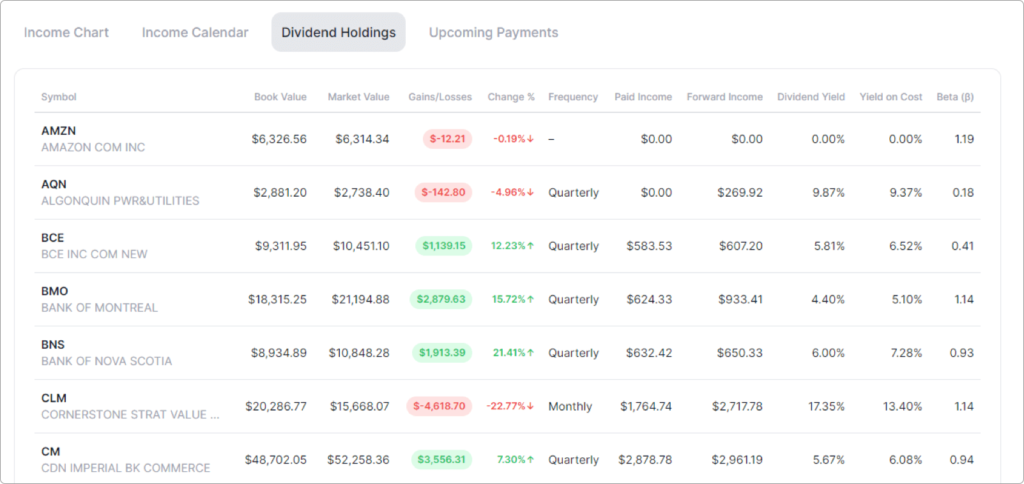

Another useful feature of the Dividend Investor power-up is the dividend holdings table. This table shows you how each of your holdings is contributing to your future income, including information such as payment frequency, past and forward income, dividend yield, and yield on cost. This can help you identify the most profitable investments in your portfolio and make adjustments as needed.

Finally, the upcoming payments table allows you to see when you can expect to receive your confirmed and estimated income payments, so you can plan accordingly.

- How to get the dividend investor Power-Up?

- Wealthica, the Dividend Investor’s Dividend Tracker

- Why use a Dividend Tracker?

- What is passive investing?

- What is a Canadian dividend investor?

- How to make a dividend tracking spreadsheet?

- Where to start if I want to become a dividend investor?

- What is a dividend stock?

- What is dividend yield?

How to get the dividend investor Power-Up?

The Dividend Investor Power-Up is has been developed and is maintained by Kamp Douangkeo, a long-time Wealthica user that also built both the Yahoo! Finance Export power up and the Excel Export Power Up that enables you to quickly make a dividend tracking spreadsheet.

It is available both as a free light version and a full version available for a very low cost of $9.99 per year (+tx). With this feature, you’ll have access to all the information you need to make the most of your dividend investments and achieve your financial goals.

To try it, just navigate to the “Power Up” section on the Desktop version of Wealthica and click on the Income Investor block in at the bottom of the page in the Third-Party section.

Wealthica, the Dividend Investor’s Dividend Tracker

One of the key features of Wealthica is its ability to track dividends. Users can see how much they have earned in dividends over time, as well as view their upcoming dividends. This allows them to plan for future cash flow and make informed investment decisions. The new Dividend Investor power up takes Wealthica’s Dividend Tracker features one step further.

Wealthica also offers a number of tools that can help users optimize their portfolio for maximum dividend income. For example, users can use the P/L power up, the Holdings page or the Income report to dig deeper into their dividend stocks. Additionally, the tool allows users to monitor their portfolio’s dividend coverage and historical dividend payout, which can be useful for identifying companies that are at risk of cutting their dividends.

Why use a Dividend Tracker?

Tracking dividends has several advantages for investors.

One of the main benefits is that it allows you to see the income you are receiving from your investments. This can help you make more informed decisions about your portfolio and adjust your investment strategy as needed. Additionally, tracking dividends can help you identify which investments are providing the highest returns and which are underperforming, so you can make adjustments accordingly.

Signup for a Free Wealthica Account Now

Dividends are a form of income that companies pay out to shareholders on a regular basis, typically quarterly. They are a way for companies to share their profits with investors, and they can provide a steady stream of income for investors, which can be particularly useful for those who are retired or nearing retirement.

What is passive investing?

Passive investing is an investment strategy that involves buying and holding a diversified portfolio of assets, such as stocks, bonds, and real estate, with the goal of achieving long-term returns. Passive investing is often contrasted with active investing, which involves trying to beat the market by making frequent trades and trying to time the market. Passive investors generally believe that it is difficult to consistently outperform the market, and so they prefer to simply buy and hold a diversified portfolio of assets that might include dividend stocks.

What is a Canadian dividend investor?

The dividend investor focuses on investing in stocks that provide a consistent stream of dividends. Dividends are payments made by companies to their shareholders, typically on a quarterly basis. Dividend investors seek out stocks that have a history of paying dividends and are likely to continue doing so in the future. The Canadian dividend investor is a dividend investor living in Canada. 🇨🇦

The goal of dividend investing is to generate a steady income from the dividends received, rather than relying solely on capital appreciation of the stock. Dividend investors often look for stocks with high dividend yields, which is the ratio of the annual dividend per share to the stock’s price per share. Dividend investors also tend to focus on companies with strong financials and a track record of paying and increasing dividends over time.

How to make a dividend tracking spreadsheet?

Wealthica can help make and automate your dividend tracking spreadsheet. You can also combine the Dividend Investor Power Up with one of Wealthica’s Dividend Spreadsheet Export power ups in order to export your holdings data to a spreadsheet. Wealthica’s export feature will export and sync your holdings and transactions to a spreadsheet which you can later customize.

Where to start if I want to become a dividend investor?

Stockchase is definitely a good place to start if you are looking to become a dividend investor. Have a look specifically at the best Canadian dividend stocks posts which will give you great tips and stock picks ideas. Stockchase suggests new dividend investors to start with the Canadian Banks stocks (td dividend, cibc dividend, bmo dividend, rbc dividend, manulife dividend, bns dividend), Canadian telecom stocks (telus dividend, bce dividend) or some other of the most popular Canadian dividend stocks (enbridge dividend, suncor dividend).

What is a dividend stock?

A dividend stock is a stock in a company that pays dividends to its shareholders. Dividends are payments made by a company to its shareholders, typically on a quarterly or annual basis, out of the company’s profits. Dividend stocks are often considered a more stable investment than non-dividend paying stocks, as they provide a regular income stream to investors.

Dividend stocks are typically found among mature, well-established companies that have a history of paying consistent dividends. These companies may be in industries such as utilities, consumer goods, or healthcare, and have a stable business model with steady earnings.

Investors can use dividends as a source of income or as a way to reinvest in the company to increase their shares. Some investors choose to invest in high-dividend stocks as a way to generate a steady stream of income, while others reinvest the dividends in order to compound their returns over time.

What is dividend yield?

Dividend yields are the most common way to measure the income generated by dividends. It is the annual dividends per share divided by the stock price. It is important to note that while a high dividend yield may indicate a good income opportunity, it could also indicate a company with a struggling stock price or financial health.

Overall, dividend stocks can be an attractive option for investors looking for a steady income stream or for those looking to reinvest in a company. However, it is important to do proper research and analysis of the company’s fundamentals and future prospects before investing in dividend stocks.

You still want to learn more about the best Canadian dividend stocks? Continue reading on Stockchase.