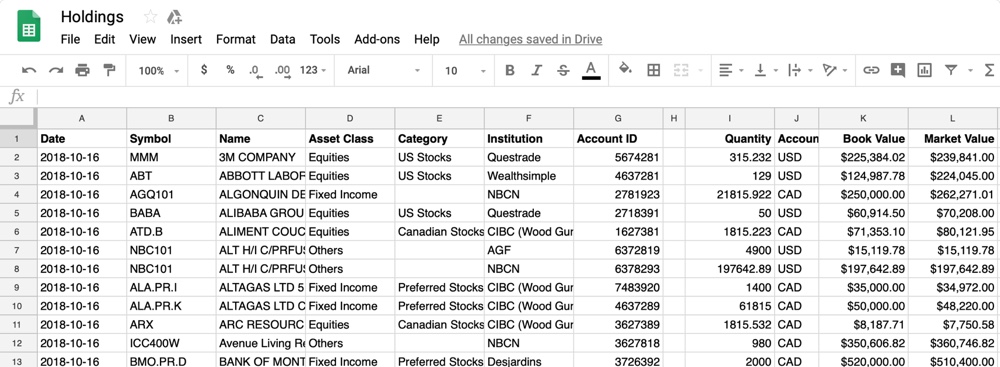

Wealthica for your financial spreadsheet

Your investments, transactions and holdings in a spreadsheet, automatically updated each day.

Wealthica syncs with Google Sheets or Microsoft Excel. It’s your choice!

“The Google Sheet Export allows me to update my spreadseet countless times, error free and I then use pivot tables for my own dashboard”

Eliminate data entry and save time with automated updates, each day

Once all your banking and investment accounts are connected to Wealthica, you can get a full overview of your financial positions and easily compare the performance across different investment portfolios. All the data is updated each day after Wealthica is done syncing with your financial institutions.

You’ll Fall in Love with Spreadsheets All Over Again

Whether you need to update your Financial Spreadsheet, track your transactions in a Budget Spreadsheet or keep your Stock Portfolio Spreadsheet in sync with your brokerage, we’ve got you covered.

1. Sign Up for Wealthica

2. Link your financial institutions

3 .Install your preferred Power-Up to enable spreadsheet export

PREMIUM

Includes Google Sheets export for FREE and 30% discount on Excel Export.

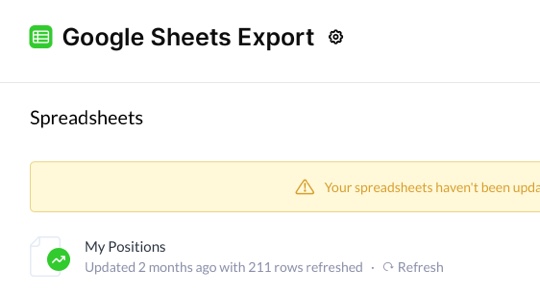

GOOGLE SHEETS EXPORT

Enables syncing and exporting your data to Google Sheets.

MICROSOFT EXCEL EXPORT

Import your Wealthica data directly into Microsoft Excel.

4. Load the power-up and link the export power-ups with your Google Sheets or Excel spreadsheets.

Wealthica Data Import add-in available from the Microsoft App Source.

You are ready to go!Get Started Free