Boxing Week sale

33% off Premium Yearly

“Incredible, amazing and useful!”

Wealthica Family

Office Edition

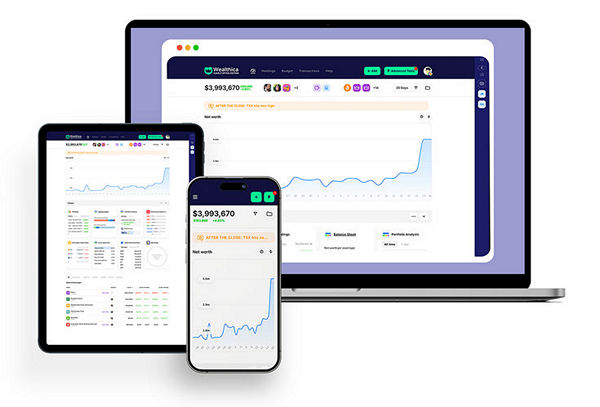

A Unified View of Your Families Wealth

Get Started

Acclaimed and Praised by Media

As Seen On

One of the best options for tracking your portfolio I... use it to aggregate all your investing accounts.

Wealthica is already recognized for its state-of-the-art features, which include automated financial aggregation.

Wealthica is one of the best tools I came across for consolidating my investments and tracking portfolio.

The Best Stock Tracking App

Delight Family Members with a Family Finance Dashboard

All holdings, across various accounts and institutions on one screen. It's financial wizardry. — Rob I.

Transaction History

Report Card

Sheets or Yahoo Finance

Advisor

Fees

Analysis

Financial Life

and Income

REPORTS

Effortless consolidated reporting for your family.

Effortlessly view your family’s total net worth online. Wealthica automatically aggregates and updates your data daily from multiple custodians or investment managers, including private investments, family businesses, and valuable assets—perfect whether you manage wealth yourself or with advisors.

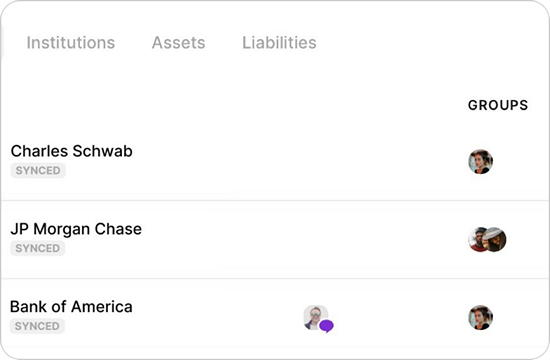

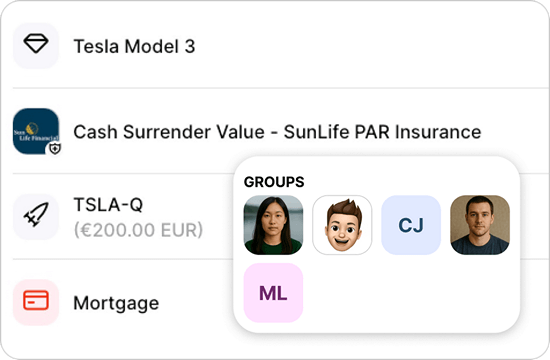

INVENTORY

Easily inventory assets and simplify generational wealth transfer.

Track and value all your assets—from investments, real estate, vehicles, and collectibles to life insurance, retirement plans, and business ownership. Wealthica helps you inventory assets, track holders, and share wealth knowledge, making family succession planning smooth, easy, and engaging. Nothing is overlooked.

“Owning and managing significant wealth does not have to be difficult.”

TOOLS

One tool to report, share, and archive.

Simplify generational wealth management and reporting. Wealthica consolidates transactions, providing easy, transparent financial data exports to Excel or Quickbooks Online.

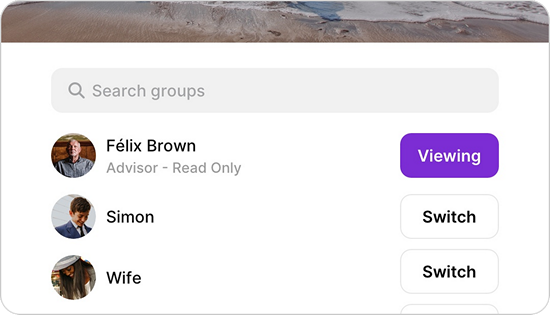

COMMUNICATION

Ensure clear, regular communication.

Wealthica clearly communicates your family’s net worth, investment allocation, income, and expenses, transforming your family office reporting.

Move Beyond The Spread Sheet Say Goodbye to Data entry

Learn more aboutSupported InstitutionsGathering, reconciling, and updating asset holdings and transactions data manually can consume a significant amount of time and resources.

Wealthica automatically retrieves and updates financial data from multiple sources, eliminating the need for manual intervention, reducing the risk of errors and ensuring data integrity.

-

Support for More Then 20,000+

Financial Institutions Worldwide -

Connect 19.000+

with Yodlee -

Connect 100+ Crypto Currency

wallets with Vezgo -

Connect instantly to 6,000+ apps

across 150+ chains with WalletConnect

FOR PROFESSIONALS

A Foundational Tool

Wealthica is emerging as an integral component for Family Offices, because consolidating information into a unified view provides Family Offices with an intimate and comprehensive overview of their wealth holdings.

Thousands Use Wealthica to Track $49B of Assets

12 month agreement, paid monthly