Index investing, passive investing or Couch Potato investing is meant to reduce your costs (i.e. low management fees) while beating most of the mutual funds and/or advisor-managed accounts. The strategy is no secret: you choose a few low cost index-trade funds (ETFs) to create your own all-ETF portfolio according to your risk profile and then…

You sit on your couch and wait for the market to grow your investments.

Or that’s what one would think.

But there’s one moment when the Couch Potato investor should get off the couch!

The secret to successful Canadian Couch Potato Index Investing is to periodically get off the couch and REBALANCE. It’s the one secret thing that will set the Couch Potato investors apart. The ones that rebalance and the ones that don’t.

If you’re too lazy to think about rebalancing, you still have some options.

- All-in-one ETFs which will do the rebalancing for you

- You can use Wealthica + Passiv to plan (or even automate) your rebalancing trades

- Do More with Passiv

- How to get started with passive or Canadian Couch Potato investing?

- Choosing the ETFs you want in your portfolio

- Canadian Couch Potato Individual ETFs Portfolio

- Determine the right allocation

- Match your Risk Profile with the Model Portfolios

- Instantly rebalance your Canadian Couch Potato Portfolio with Passiv & Wealthica

- See all your investments in one place

Do More with Passiv

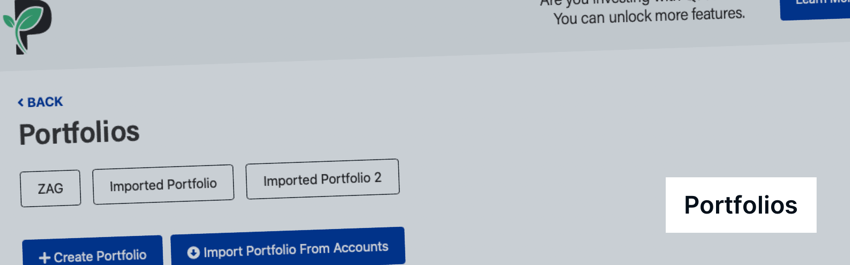

Wealthica allows you to instantly connect Passiv with 100+ Canadian financial institutions and automatically import your ETF portfolios into Passiv.

How to get started with passive or Canadian Couch Potato investing?

Basically the perfect Canadian Couch Potato Investing strategy is implemented in 3 easy steps…

1. Choose the ETFs you want in your portfolio

2. Determine the right allocation

3. Rebalance (easily with Passiv & Wealthica)

Choosing the ETFs you want in your portfolio

The beauty of ETFs is that you can select an ETF for each sector or index in which you want exposure. Analyze the available funds and determine which ones will best meet your allocation targets.

The strategy works with any set of ETFs but you should usually make sure to create diversification and include multiple asset classes. You can refer to Stockchase’s Mega-List of ETFs, ETFs for Everyone and Top Emerging Markets ETFs posts for some guidance to choose the ETFs you want in your portfolio.

Since you will be buying and selling ETFs, you might want to choose a commission-free ETF brokerage such as Questrade (which allows you to buy ETFs for free) or Wealthsimple Trade (which offers you the ability to buy or sell ETFs for free). Read our Questrade vs Wealthsimple trade post if have a hard time choosing between Questrade or Wealthsimple Trade.

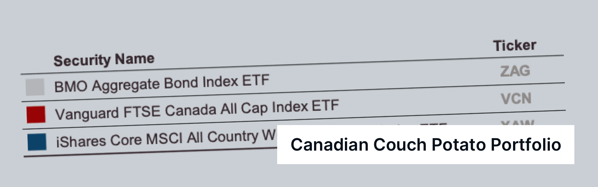

Canadian Couch Potato Individual ETFs Portfolio

If you prefer to go for simplicity, you could choose the Canadian Couch Potato Individual ETFs portfolios.

It consists of :

- ZAG.TO : BMO Aggregated Bond

- VCN.TO : Vanguard FTSE Canda All Cap

- XAW.TO : iShare Core MSCI AlL Country World ex Canada

Determine the right allocation

You have chosen your preferred set of ETFs, and now you need to determine the right allocation or what percent of your portfolio you will assign to each of the ETFs.

What are your objectives for this portfolio? Is it for retirement? How far away is retirement? Are you saving to buy a new house? What are your return and risk expectations?

The longer you are willing to stay invested, the more risk you can take.

If you are not sure about your risk profile try a risk tolerance calculator like CalcXML‘s.

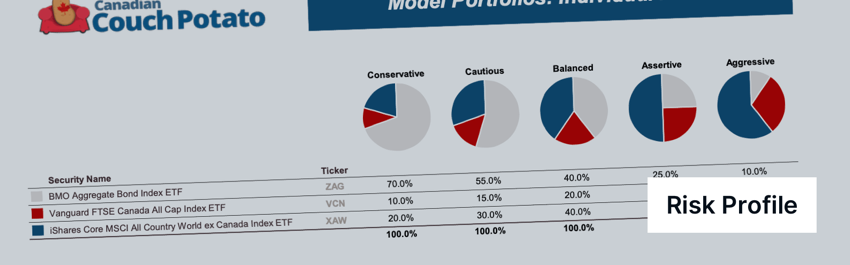

Find out your risk profile and then match it with the ones you find on the Canadian Couch Potato’s Individual ETFs Model Portfolios : Conservative, Cautious, Balanced, Assertive or Aggressive.

Match your Risk Profile with the Model Portfolios

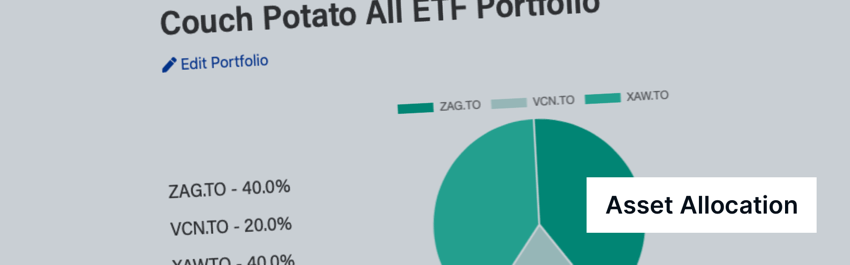

If you are a Balanced Investor, you would assign 40% to Fixed Income (BMO Aggregate Bond Index ETF), 20% to Canadian Equities (Vanguard FTSE Canada All Cap Index ETF) and 40% to International Equities (iShares Core MSCI All Country World Index ETF).

Instantly rebalance your Canadian Couch Potato Portfolio with Passiv & Wealthica

Passiv Lite is available as a free add-on you can use with Wealthica. The following Passiv features are supported by Wealthica :

– Import and save your ETF portfolio

– Set your desired allocation (% to each ETF)

– Generate trades to rebalance

You can use Passiv Lite on-demand to generate a list of trades you should do to rebalance your portfolio allocation and make sure you respect your risk tolerance and the asset allocation you selected.

Using Wealthica + Passiv Lite + Canadian Couch Potato Portfolios is totally free.

See all your investments in one place

Connect Passiv Lite with your ETF portfolio