I was using Mint for a number of years and have been a Wealthica user for around three years. Initially, I thought that there was not much comparison between Wealthica vs Mint, but in reality they are quite different. Although they are both net worth trackers, Mint is more for day-to-day budgeting and Wealthica is more for investment tracking. I actually prefer using Wealthica since I don’t tend to budget anyways (and instead favour the ‘pay yourself first’ approach) and I like to track my net worth.

We updated this post recently after Mint announced it was closing. There could be some edits to the orginal post from the Wealthica team. This was originally written by the team behind the Genymoney.ca, a Canadian personal finance blog. The writer behind Genymoney.ca has been writing about personal finance for over 11 years and originally created one of the top personal finance blogs in Canada, Young and Thrifty. She is a frequent Wealthica user and is happy to share her experience with both Mint and Wealthica.

Wealthica recently published a Mint Export guide for users that want to import their Mint Export Data Backups to Wealthica.

There are a number of reasons why I stopped using Mint and decided to look instead for Mint alternatives in Canada. As mentioned, I didn’t really like the budgeting aspect of Mint because I don’t like to budget since I tended to go over budget . I also thought that having to repeatedly sync my accounts with Mint was getting annoying. Finally, this is a silly reason, but I did not enjoy the passive aggressive email notifications from Mint such as “This month you spent $100 on haircare. You might want to look into that”.

In this article, I will go over what Mint is, what Wealthica is, and the similarities and differences between Mint and Wealthica. ?♂️

- What is Mint (the budget tracker)

- How to add accounts to Mint.com?

- Budgeting with Mint

- Net worth tracking capabilities

- What is Wealthica?

- Is Wealthica a good Mint alternative?

- Enhance Wealthica with Add-Ons

- My Wealthica Net Worth Tracker Review

- Adding your accounts to Wealthica

- Wealthica vs Mint Similarities

- Wealthica vs Mint Differences

What is Mint (the budget tracker)

Mint.com is a free budget tracker and planner service for users in Canada and the United States. You log into one interface (Mint.com) and then can see your budget for the month, track your spending, see your credit card transactions, and see your investment balances. Mint.com was created by Aaron Patzer and was acquired in 2009 by Intuit (they make Quicken and TurboTax).

Before you are able to see all your data on one interface though, you have to share your user name and passwords to for your bank accounts, credit card accounts to Mint.com.

Mint.com stores your information in their database – there have been concerns that if Mint were ever to be hacked, your passwords would be shared with third parties. However, to my knowledge, this has not happened yet (knock on wood).

How to add accounts to Mint.com?

The first step before you can use Mint is to connect your accounts.

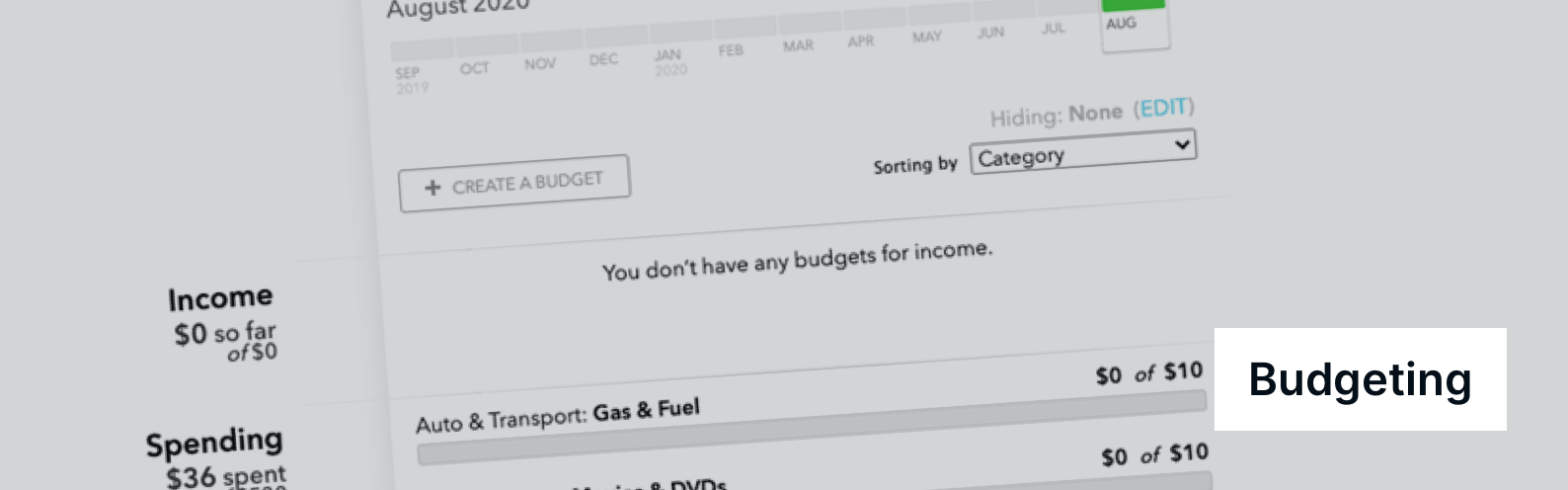

Budgeting with Mint

Once you linked your accounts, Mint allows you to see all your financial information in one place, including your net worth. You can also personalize your Mint account by creating a budget. You can create your own budget and your transactions will automatically get inputted into your budget (provided they are not cash transactions, of course).

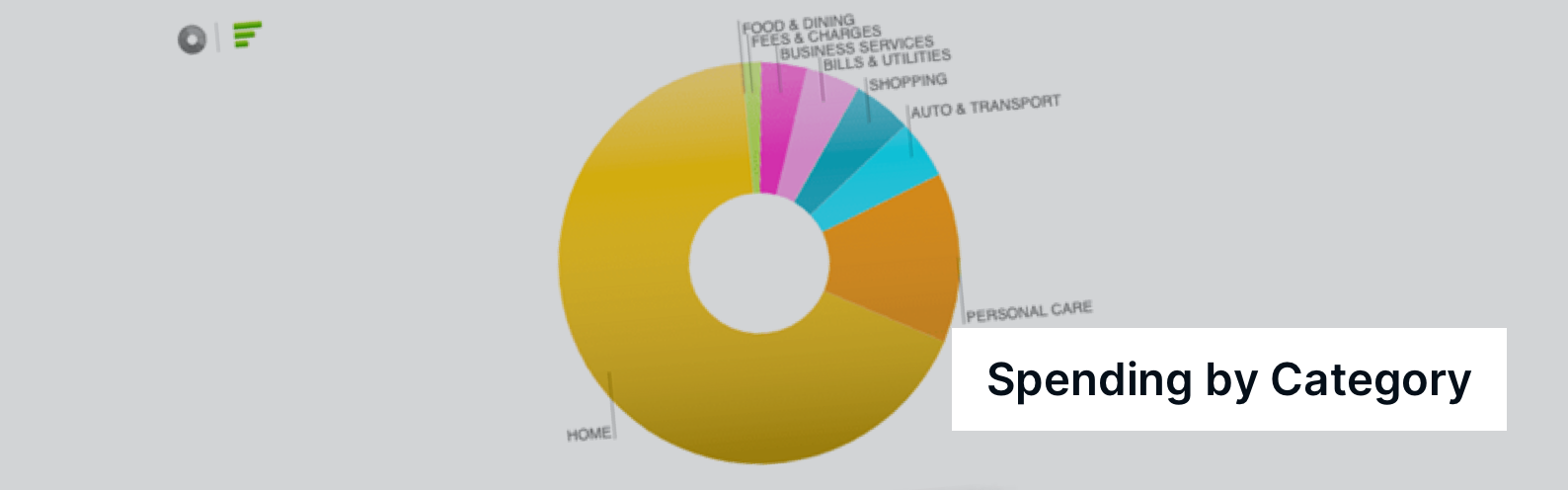

One neat thing that Mint.com does is that it can graph out your spending by category. The Mint.com spending chart provides a good sense of where your money goes.

Another unique aspect to Mint that Wealthica does not have (because Wealthica is more focused on seeing the big picture of your investments) is that you can set personal goals for yourself.

Net worth tracking capabilities

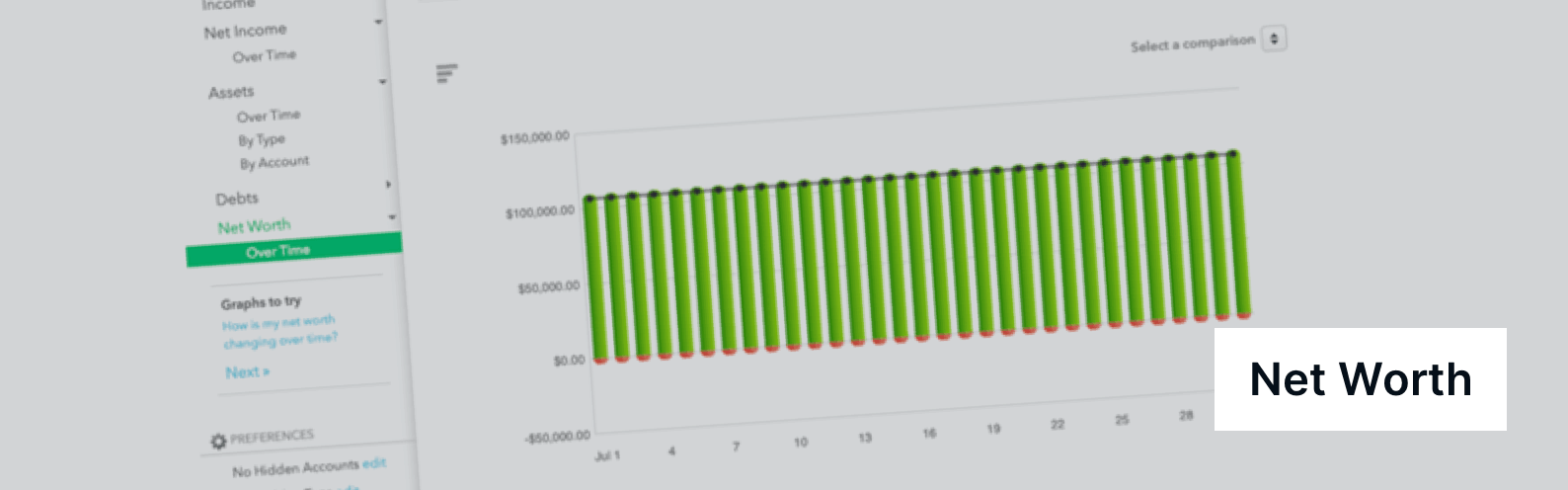

Finally, since both Mint.com and Wealthica have net worth tracking capabilities, this is what the net worth section on Mint looks like, it gives you a snapshot and comparison over time in a bar chart format. If you are into savings and investing rather than day-to-day spending analysis, you might really want to look at Wealthica further.

What is Wealthica?

Wealthica is a free net worth tracking and investment portfolio tracking website where you can see all your information on a single dashboard. You can see a consolidated version of all your investments in one place with Wealthica.

Being able to see all your investments in one place is especially useful for example, if you have a TFSA with Questrade, and your non-registered and RRSP accounts with BMO Investorline, for example. Or if you have a non-registered account with Wealthsimple Trade and you have a TFSA and RRSP with Questrade.

Wealthica was founded in Montreal, Quebec by Martin Leclair and Simon Boulet. It was created because they wanted a simple solution to having a number of different investment accounts.

Is Wealthica a good Mint alternative?

There are a few good Mint alternatives. One can think of Quicken or YNAB first, but Wealthica is a great Mint alternative, especially if you hold investments. Wealthica is similar to Personal Capital in the United States, except Personal Capital does not recognize any Canadian financial institutions or accounts.

Enhance Wealthica with Add-Ons

Wealthica makes money by adding advanced reporting options and add-ons and but there are a few free add-ons I find very useful. Some free Wealthica Add-Ons that I find very useful are the:

- Income – Tracks dividend income and graphs it out in a bar chart format

- Fees – It shows you how much you have spent lose in fees

- Performance – Compares your portfolio performance to the S&P 500 or S&P/TSX Composite

- Realized Gains – This one helps calculate your gains (or losses) when it’s tax time

You can easily install add-ons from inside Wealthica by navigating to the desired add-on page and clicking on the Install button.

My Wealthica Net Worth Tracker Review

I did not review Wealthica in full details in this post, but I wrote a complete Wealthica Review on my blog, Genymoney.ca. For more information, here is my Wealthica Review.

Adding your accounts to Wealthica

Like Mint.com, it is simple to add an investment on Wealthica:

Wealthica also has a net worth tracking tool and you can add family members accounts too. Tracking your investment performance and net worth is very easy with Wealthica and you get a nice snapshot of your net worth or investments over time:

Wealthica vs Mint Similarities

There are a few ways Mint and Wealthica are similar and a few ways in which Mint and Wealthica are different. Here are some of the similarities.

- Mint and Wealthica are both free to use

- They both support a large number of Canadian financial institutions

- You manually input your hard assets (e.g. real estate)

- They both automatically sync to give you and updated picture of your net worth

- Wealthica will soon add a budget add-on to track your spendings…

Wealthica vs Mint Differences

As mentioned, there are a number of differences between Wealthica and Mint. Here are some of the more notable differences with Wealthica vs Mint.

- Mint is more of a day-to-day budgeting personal finance tool

- Mint is good for tracking your spending

- Wealthica is more of an investment tool, it is good for tracking your investments

- You can’t track dividend income from Mint

- You don’t see a historical picture of how your investments are doing over time on Mint

- Unlike Mint, Wealthica uses API authorization when available (Questrade, Wealthsimple, and Interactive Brokers) and Mint does not.

- There is a default Private Mode that shows the graph without specific numbers on Wealthica.

- With Wealthica, you can also add family members accounts too to track their net worth.

In summary, Mint and Wealthica are actually pretty different even though they both track your net worth. Although they can both technically track your net worth, Wealthica is more geared towards investing and Mint is more geared towards the day-to-day budgeting and income and expenses.

Wealthica is an excellent tool to help you track your investments and your net worth. The graphing and chart capabilities of Wealthica are second to none. Although you could probably export the data from Mint into a chart, that’s just too much work for chart and Excel illiterate me.

Personally I prefer using Wealthica to track my investment portfolio since I don’t tend to do day-to-day budgeting anyway. I like how you can toggle the time frame that you’re looking at easily, and how you can access information easily.

I stopped syncing my Mint.com accounts since 2018 because I didn’t find it useful, but have been an avid Wealthica user since 2017 because it is so useful.