Boxing Week sale

33% off Premium Yearly

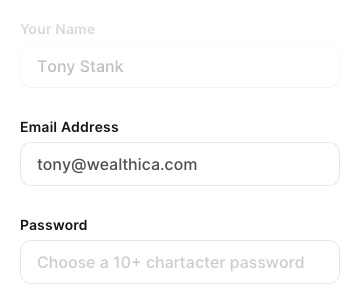

Say Goodbye to Data Entry

We simplify your financial life.

Relax, sit back and let us do all the hard work while you grow your wealth.

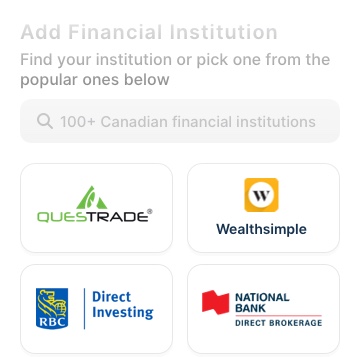

What does Wealthica sync?

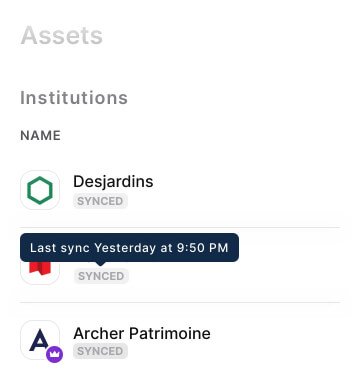

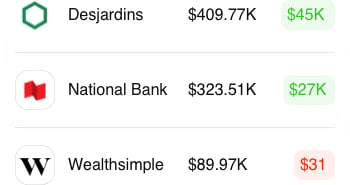

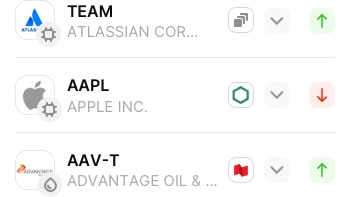

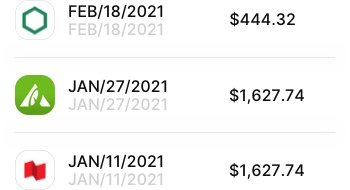

Wealthica will sync your balances, holdings and unlimited transaction history.

Learn more about how Wealthica collects your financial dataWealthica Empowers You with your Financial Data to Make Better Decisions with your Money

“Wealthica is a great tool to consolidate your investments and banking information. It is way easier to have an overview of your finance and therefore make better choices and have a dedicated action plan.”

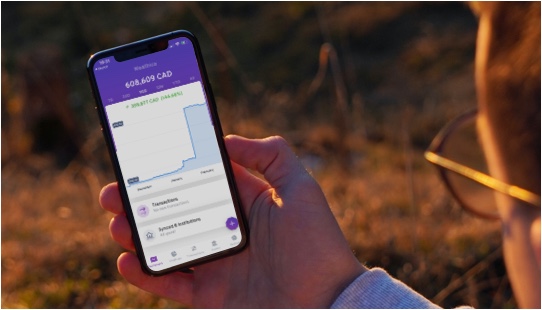

Read more Before & After Wealthica TestimonialsYour net worth with you, wherever you are

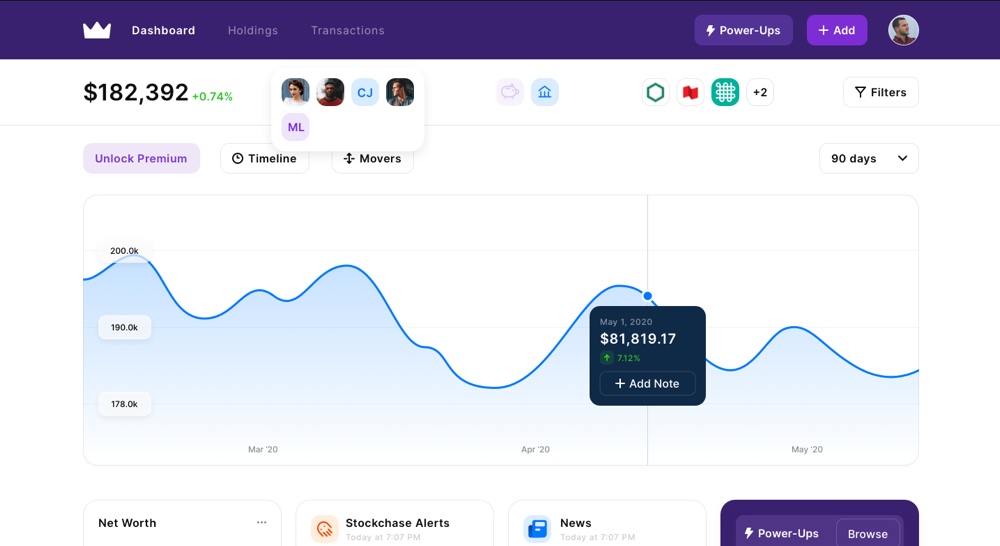

Wealthica is an app that makes it easy to track your net worth and keep a historical view of how it evolved. It allows you to easily focus on the big picture while enabling you to track your progress towards your financial or retirement goals. The Wealthica Mobile App is the perfect companion to Wealthica’s web dashboard.

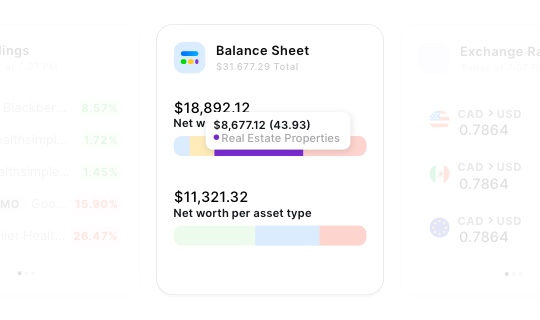

An up-to-date balance sheet for the whole family

Get an overall snapshot of your wealth at a specific period in time. Create groups or family members and automatically generate your personal and family balance sheet. Assign accounts and assets to family members and track the whole family’s net worth easily.

Measure your progress to reach your financial goals

With historical data and event annotations, Wealthica allows you to see how your net worth and investment portfolio evolves over weeks, months and years. Wealthica saves and archives your transaction and balance history forever even when you switch or transfer to a new bank or brokerage.

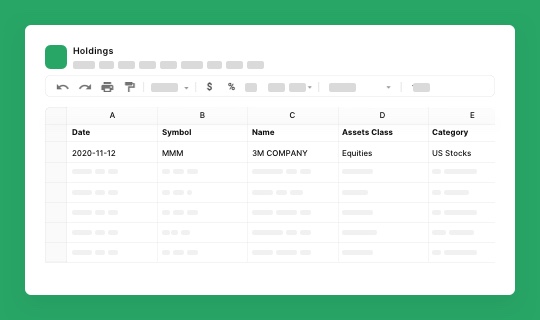

Export your consolidated data for enhanced reporting or taxes

Export your transactions, holdings and balances to your own Google Sheet or Excel Spreadsheet in one click and build your own enhanced reports. Export your portfolio holdings to CSV and import it back into Yahoo! Portfolio or your preferred portfolio tracker for real time portfolio tracking.

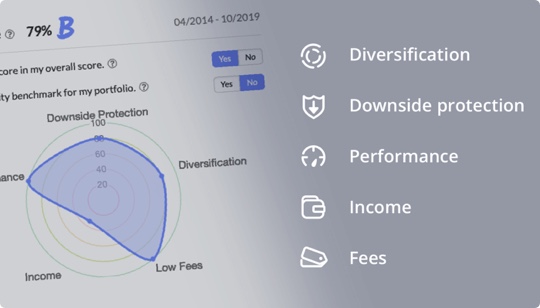

Analyze your portfolio and accurately assess fees

Investment fees quickly add up. Management fees, transaction fees, custodian fees. Wealthica allows you to analyze and track how fees will affect your portfolio performance over time. Review the strengths and weaknesses of your current investments one account at a time, or group accounts together for a big picture analysis. Compare your accounts performance and fees across your different financial institutions.

Track your expenses, build a simple budget

You can track your monthly income and spendings, categorize these spendings and income transactions, control your budget and set goals for each category. Know how you spend your money to more effectively control your personal finance and plan for regular savings or debt repayments.