What’s new for Wealthica in November December….

December is already here. ?

It’s almost time for us to wish you a Merry Christmas and Happy New Year!

Let’s put your Black Friday and Cyber Monday shopping lists aside for a few minutes and review what’s been happening in December for Wealthica.

We’re at B

We won’t be bragging about our total aggregated investments each month and maybe making it our headline two months in a row is kind of too much. Is it? We’ve reached $5B in aggregated assets. It’s a nice number, and a nice reminder that we’re heading to $10B. One more reason to cheer for during the holidays. ?

Welcome to Eric Lemieux!

Here’s a scoop for you, the privileged Wealthica users! ?️♂️

Eric Lemieux, formerly CEO of Finance Montréal and Senior Vice-President at Desjardins, joins Wealthica. Eric will help us take Wealthica to the next level by focussing on relationships and monetization opportunities with financial advisors and financial institutions. It should also help me and the rest of the team focus on the product and bringing you more of your requested features!

Now onto the new features…

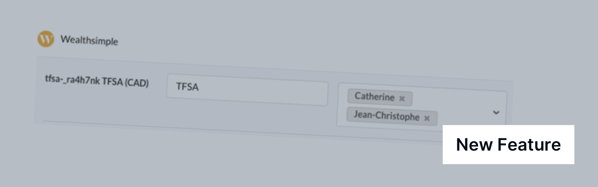

Assign an Account to Multiple Groups

Up until now, an account or asset you have in Wealthica could be assigned to a single group. We had a few requests to allow assigning an asset or account to multiple groups.

It’s now possible. ✔️

Support for LendingLoop and More Institutions

We added support for several a few more institutions. We had many requests for Lending Loop support, it’s finally available along with a few others.

– Credential Securities

– Lending Loop ?

– Desjardins My US Card

– ModernAdvisor

– PWL

– Fidelity Clearing (Out of beta)

– RBC Wealth Management (BETA)

– Laurentian Bank Securities (BETA)

– BMO Private Banking Investments (BETA)

– Coast Capital Savings (BETA)

Banking; Mortgage and Credit Cards

We quietly introduced support for Mortgage and Credit Cards from banking institutions. Those accounts are hidden by default but you can go to your accounts list for an institution and uncheck the hidden checkmark to show them on your dashboard.

You Want to Support Wealthica?

From time to time, some of you ask us how you can support Wealthica.

Here are a few ways:

Signup for Stockchase Premium

In case you didn’t know, we also run Stockchase which publishes stock opinions daily. The main feature of Stockchase is the newsletter which delivers daily top picks to your inbox. Signing up for the Premium version of Stockchase costs $99 per year and is a really great way to support us. In the future Wealthica Premium and Stockchase Premium might be bundled in the same premium subscription. Get it here.

Signing up for Questrade

You can also open a Questrade Account after following our affiliate link which you can find here and run 10 trades (free) and we will get paid for the referral. We’ll get our referral commission only if you run 10 trades so don’t bother signing up if you don’t plan to use it, it wouldn’t really help support us. ?

Signing up for Wealthscope Portfolio Scorecard

We partnered with Wealthscope to offer a Portfolio Scorecard service. You can sign-up for Wealthscope from the Add-On menu in Wealthica (web version). You’ll get a scorecard of your portfolio and other analysis from Wealthscope. The revenues are shared with the team at Wealthscope. It’s a great way to support both Wealthica and Wealthscope, two great Canadian fintech startups!

Signing up for Google Spreadsheet Export

The Google Spreadsheet export on Wealthica is a paid feature. It’s 5$ per month. We are planning to bundle this into a Premium subscription in the future but for the moment it’s another way of supporting us financially.

Thank you!

Thank you for reading and have a great holiday season.

We’ll be back with more product updates, more new features and a bigger number for assets under aggregation next month. ?