We started building Wealthica in April 2015.

At that time, it was all about building something to solve our problem. We had begun investing and weren’t happy with the products available on the market.

Since building technology is second nature to us, we were confident that we could build something better. So we went along with our idea.

When our product was well on his way, we decided to get some feedback from other users. We did that by launching a private “beta version” (it’s about a year and a half ago now).

We got a bit of press coverage from that, especially in Québec, which attracted many users. For us, it was evident then, from that public response, that other people could benefit from Wealthica.

Today we’re ready to take the next step.

We feel it’s time to share Wealthica with the World instead of with just a few.

And we’re taking another approach this time. This blog series will document everything.

Since we’ve learned a lot while investing (and still do), we think that sharing our experiences as product makers, investors and entrepreneurs from the very beginning will be more beneficial to you, the readers.

You’ll know it all.

- Where we invest our money

- The good and the bad moves; Where we lose money

- What mistake we did

It starts with this blog, but expect to see and hear more and more about Wealthica in the months to come as we will be actively working on getting the word out.

But first, let me give you a little background about ourselves.

From Internet infrastructures to fintech

I sold my first startup Netsimplify to iWeb a few years ago. That’s when I started investing. A few years later we privatized iWeb and got to exercise our stock options. I got a bit further into investing again. And then, only 2 years later, we sold iWeb to Internap.

I should have started learning about investments earlier.

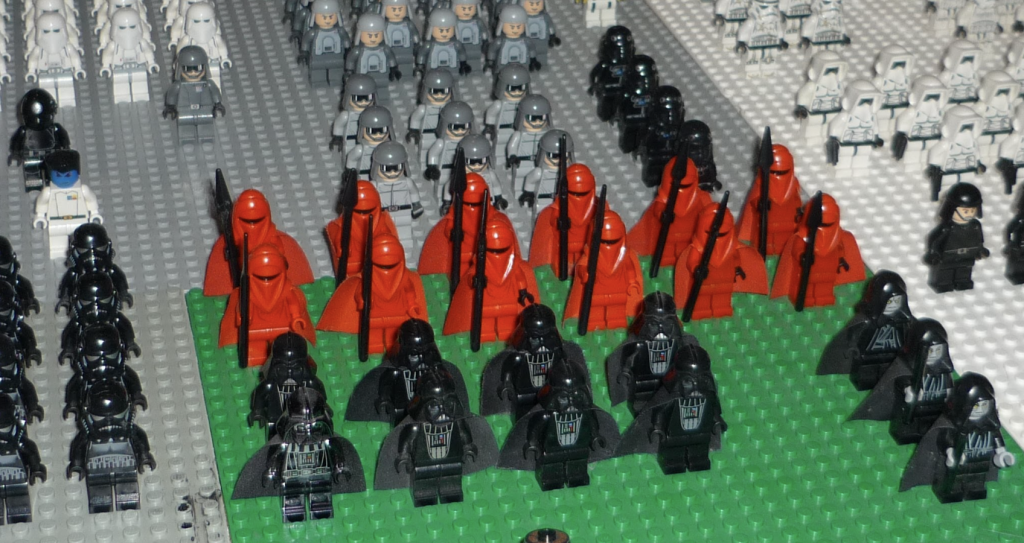

“Wow, we are starting to build an empire, and we have access to the “Imperial” treatment.”

We felt “the force” was with us, and we decided to build the foundations of our Imperial Army with them.

We quickly realized instead that we had been introduced to the dark side of the force. But, we knew that in the end, Jedis always win.

Could the DIY investors be the Jedi’s of investments? Imperial Service was supposed to help reach our goals, do a comprehensive financial plan and manage our money.

In reality, it consisted in this:

- Give us your money!

- We’ll invest it in popular funds (with high fees, trailing fees, and commissions)

- You’ll be all set for a great rollercoaster ride!

We stayed for 3 months and withdrawn everything.

Multiple financial institutions and no way to track our complete investment portfolio

After our bad experience, we decided to move slowly this time and start experimenting with multiple investment strategies.

Not the ideal situation, but still an interesting one. We had 10 institutions we could try and compare and 4 financial advisors we could learn from.

Still, it was impossible to know exactly where we were generating the most revenue and where we were paying too many fees.

We had thought about using an aggregation engine or investment dashboard before, but now we really needed one. But comparing to our US friends, we Canadians had no options available. There was Mint, but it doesn’t handle investments. There’s Personal Capital, but it does not support Canadian financial institutions. Nothing.

– No way to track our complete investment portfolio

– No way to quickly know our current net worth

– No way to understand exactly how much fees we were paying

It was obvious, tracking our financial life was a pain. The idea for Wealthica came up at this point: we had an urgent need to better view, monitor and compare investments.

We quickly built a smaller version of what would be Wealthica and let other use it. We immediately started to get some good feedback and all of a sudden it began to look like a real business opportunity.

Why B Aggregated Net Worth?

Back to this “$10 billion journey”.

We love the Million Dollar Journey.

We love Groove’s Startup Journey to $10M a year.

And as a startup, we need a goal to motivate us. No rocket science.

Hence the $10B aggregated net worth journey. All Financial Advisors and Wealth Management firms compare themselves with how much money they have under management.

So why not link Wealthica’s success to the sum of all assets and investments it tracks. We first started, with $1B as a goal, but it didn’t take long until we almost reach that number already.

(To this day, we’ve already passed the $500M mark.)

The scale of 750 SMB Advisors

What’s $10 billion in aggregated assets anyway?

If you do the math, that means when we’ll reach $10 billions aggregated net worth we’ll have the scale of more than 750 SMB Advisors.

According to Advisors.ca, aggregating $10B would position us in the top 10 in term of AUA (Assets Under Administration). OK we don’t administer assets, we don’t advise anyone, and we don’t sell investment products, but still, we like to entertain the idea that the aggregated net worth of all our users represent how much our product is impactful to our users.

With a user base representing an aggregated net worth of $10 billion can we assume banks might listen when we say that our users want open access to their financial data?

Ranking of total AUA base by firm:

1. RBC: $297.4 billion

2. BMO: $140 billion

3. Scotiabank: $128 billion

4. TD: $125.1 billion

5. CIBC: $124 billion

6. National Bank: $88.4 billion

7. Raymond James: $26.9 billion

8. Richardson GMP: $26.3 billion

9. WEALTHICA AFTER WE REACH OUR $10 BILLION GOAL

10. Canaccord Genuity: $9 billion

11. Echelon Wealth Partners (formerly Euro Pacific Canada): $4.2 billion

Source Advisors.ca

What if Guy Laliberté signs up? Wouldn’t you reach too fast your goal?

A VC we were having discussions with asked us if our $10 billion goal was really meaningful. “What if Guy Laliberté signs up?” he said.

According to Wikipedia, Guy’s net worth is $1.3 billion. This would account for more than 1/10 of our $10 billion goals.

Guy, if you’re reading this, we’d be more than happy if you sign up! We’re confident Wealthica could be useful to your family office.

Would this move us too quickly towards our goal?

Is a single user accounting for $10B aggregated net worth possible? The truth is we don’t have any $1B net worth user yet, so 10B feels just about right as a goal.

Of course, the aggregated net worth of Wealthica is not the only important metric for us, our number of active users is also very significative. That being said, if Guy Laliberté signs up, we think it’s worth 1/10 of our goal.

Wouldn’t it be an incredible endorsement to Wealthica’s credibility if public figures like him sign up and actively uses it? You bet.

So, we definitely welcome ultra-high net worth investors to use Wealthica. And if we get to our $10 billion goals too fast, the next goal will be $50 billion.

We started building this blog with a $1 billion goal in mind and had to push it to $10 billion because we are getting too close to the $1 billion mark. We would be more than happy to push our goal again if Guy or anyone else helps us getting to $10 billion quicker than expected.

As a first-mover in the USA, Personal Capital tracks $326B+ in aggregated assets today (320M population in the USA). We believe Wealthica can succeed at the same scale as a first-mover in Canada and ultimately track $50B+ for a population of $36M+. Join free and help us reach our goal!

What you’ll learn

Isn’t growing your investments your advisor’s job? There’s a lot of DIY investors out there too.

Starting with our next post, we’ll talk about the strategies and tactics our users use to grow their wealth (with their authorization).

Since we’re also investing, we’ll also share our good moves and bad moves, the lessons we learned, and how you could avoid them.

Those include:

- How lowering and tracking your fees can help you grow your net worth

- When ETFs beat the financial advisor, you’re paying thousands per year

- How you can lower your accounting fees using Wealthica

- The best resources on finance and technology (we are aggregation specialists after all).

- Insights about what the riches are buying

- Stock picks and ideas

- Insights about average performance and what you should expect

- Our own experience growing iWeb and now Wealthica

- ETFs vs Financial Advisors

And more. What would you like us to write about?

[optin-cat id=337]

What’s next?

We hope you’ll join us on our journey.

You don’t have to be a Wealthica user (but you’re invited to sign up for free here). To get notified when new posts are published, sign up for the $10 billion mailing list below.

Have something you want to learn more about? Let me know in the comments or hit me up on Twitter.