In theory, a Family Office could centralize its wealth at one institution. In practice, no sophisticated UHNW structure ever does.

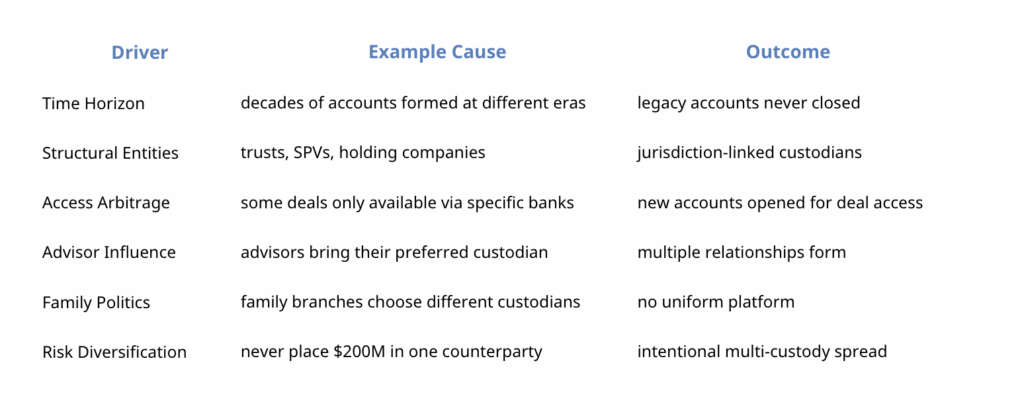

WHY? Because wealth is not a single event. Assets are acquired across multiple eras, jurisdictions, advisors, mandates, deal structures, and family branches. Each new layer of wealth formation tends to create a new “endpoint” where assets reside.

This produces a natural proliferation of custodians. And Family Offices do not “fix” sprawl because the cost, tax friction, and loss of access involved in unwinding legacy accounts is often worse than simply tolerating the fragmentation. The outcome is multi-custody as a permanent operating state.

DRIVERS OF ASSET SPRAWL

THE COSTS OF SPRAWL BECOME INVISIBLE-UNTIL FAILURE

From the outside, a Family Office may appear highly controlled. Internally-the data layer is often brittle.

- Reporting is assembled manually.

- Month-end reconciliation is fragile.

- Data never balances out cleanly on the first pass.

- Estimates masquerade as truth.

The single greatest operational risk inside Family Offices today is not volatility-it is fragmentation.

HOW WEALTHICA SOLVES ASSET SPRAWL

Wealthica doesn’t fight sprawl – it makes sprawl irrelevant.

Multi-custodian is permanent. It’s structural. It’s guaranteed as wealth compounds.

Wealthica’s role is to neutralize the operational burden that comes from that sprawl.

THE 4 WAYS WEALTHICA DOES THIS

1) Automatic aggregation

Wealthica pulls in all custodians, banks, brokers, and even alts data – automatically.

No more copying numbers across statements.

2) Normalization

It standardizes the data

Different custodians but identical data structure.

3) Single Consolidated View

You don’t jump system-to-system or tab-to-tab.

You have one screen that shows ALL accounts.

4) Governance-grade reporting

Because data comes in normalized and validated, reporting becomes:

- faster

- cleaner

- less error-prone

- less key-person dependent

This is why Family Offices need to embrace aggregation.

THE GOVERNANCE IMPERATIVE

Since sprawl cannot sustainably be eliminated, the only rational path is to neutralize it.

This is done by aggregating and reconciling data above the custodial layer.

A single aggregated view is not convenience; it is governance and is rapidly becoming the baseline expectation for institutional-grade Family Office operations.

In 2026, the advantage isn’t a better custodian – The advantage is a single consolidated view.

All holdings, across all accounts and institutions on one screen- automatically. This is where Wealthica is powerful.

We currently support for more than 20,000+ Financial Institutions worldwide with +$49.0 Billion in aggregated assets tracked on our platform.

For more information or to book a Family Office Data Assessment email us at: sales@wealthica.com

We’ll show you how Wealthica can consolidate all your holdings, across all accounts and institutions on one screen- automatically.

To download our next Whitepaper: Manual Consolidation – Risk & Latency fill out your contact information below and we’ll send it to your email.

Get the next Whitepaper: Manual Consolidation – Risk & Latency